A checking account is a service provided by most banks, which allows individuals and businesses to deposit money and withdraw funds from a Federal Deposit Insurance Corporation (FDIC) insured account. The terms and conditions of a checking account may vary from bank to bank but in general, a checking account holder can use personal or business checks in place of cash to pay debts. Most checking accounts allow customers to withdraw their money using an ATM machine.

Almost all banks offer some form of checking account service to their customers. Some may require a minimal initial deposit before establishing a new account, along with proof of identification and a physical address. A student or other lower income applicants may opt for low-featured checking account, which does not charge fees for the use of personal checks and other limited services. Other applicants opening traditional checking accounts may benefit from interest payments by maintaining a high minimum balance each month.

Checking Basics

A typical checking account will handle deposits and withdrawals. The account holder has a supply of official checks, which contain all of the essential routing and accounting information. When a check is written the account holder's account is debited the amount of the check. The account holder is ultimately responsible for keeping track of their available funds, even though the bank will issue monthly statements.

When A Check Bounces

Checks must represent an actual amount of money within in the checking account. If a check is written for an amount higher than the available balance and the bank pays that fee, then the account holder will face an overdraft fee and potentially legal action. Further, the recipient of the bad check may also incur fees if the check bounces. Then account holder may end up owing fees to both his bank and the recipient's bank.

The recipient of the bad check can demand immediate cash payment for the original debt as well as a substantial fee for the returned check. Some banks will protect checking account holders by making the proper payments and notifying the account holder that an overdraft has taken place. Most times the bank will recoup their losses through substantial service charges, so avoid writing checks when the balance is unknown.

()

Debit Cards

A debit card (often referred to as a check card) resembles a credit card and provides an alternative payment method to cash when making purchases. The card is an International Organization Standard (ISO) 7810 card, which is similar to a credit card. However, its functionality is more similar to writing a check as the funds are withdrawn directly from either the cardholder's bank account or from the remaining balance on a gift card.

Depending on the store or merchant, the customer may swipe or insert their card into a credit card terminal or they may hand it to the merchant who will do so. The transaction is authorized and processed and the customer verifies the transaction either by entering a PIN or by signing a sales receipt.

The use of debit cards has become widespread in many countries and has overtaken the check and traditional cash transactions. In is very important to be mindful of what is spent by maintaining your check registry or bank book to avoid overspending.

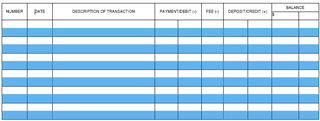

Sample check registry